Different Types Of Cap Rates . capitalization rates are a universal benchmark for comparing investment opportunities across different property. two types of cap rates are commonly used in property valuation. Some aggressive investors target cap rates above 8% or. Cap rate, or capitalization rate, measures return on investment in commercial real estate, similar to pe. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. generally, a “good” cap rate is between 5% and 10%. a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. Gross capitalization rate (gross cap rate) is. some specific elements that can influence cap rates are property location, condition, asset class, investment size,.

from rethority.com

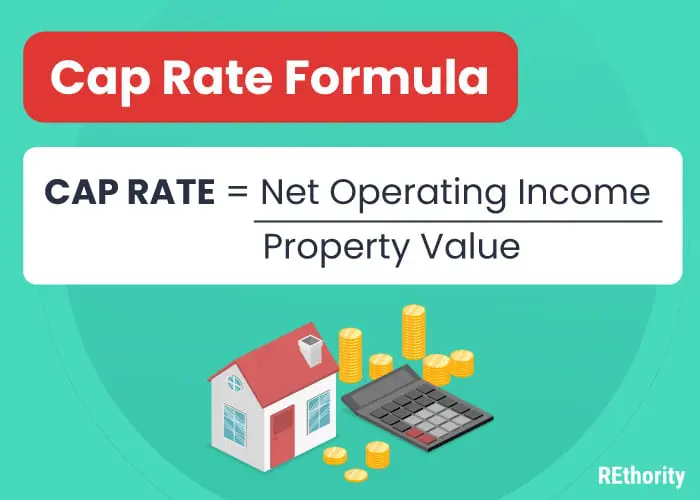

a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. generally, a “good” cap rate is between 5% and 10%. some specific elements that can influence cap rates are property location, condition, asset class, investment size,. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. Some aggressive investors target cap rates above 8% or. two types of cap rates are commonly used in property valuation. capitalization rates are a universal benchmark for comparing investment opportunities across different property. Cap rate, or capitalization rate, measures return on investment in commercial real estate, similar to pe. Gross capitalization rate (gross cap rate) is.

Cap Rate Calculator What It Is And How It Works

Different Types Of Cap Rates some specific elements that can influence cap rates are property location, condition, asset class, investment size,. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. Gross capitalization rate (gross cap rate) is. generally, a “good” cap rate is between 5% and 10%. two types of cap rates are commonly used in property valuation. a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. Some aggressive investors target cap rates above 8% or. capitalization rates are a universal benchmark for comparing investment opportunities across different property. some specific elements that can influence cap rates are property location, condition, asset class, investment size,. Cap rate, or capitalization rate, measures return on investment in commercial real estate, similar to pe.

From investmentmoats.com

A Definitive Guide to CAP Rates, Net Property Yield in Property Investing Investment Moats Different Types Of Cap Rates some specific elements that can influence cap rates are property location, condition, asset class, investment size,. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. Some aggressive investors target cap rates above 8% or. Cap rate, or capitalization rate, measures return on investment in commercial real estate, similar. Different Types Of Cap Rates.

From www.fe.training

Cap Rates in Real Estate Definition, Formula, Calculation Different Types Of Cap Rates a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. Gross capitalization rate (gross cap rate) is. generally, a “good” cap rate is between 5% and 10%. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. Some aggressive investors. Different Types Of Cap Rates.

From endel.afphila.com

Capitalization Rate Overview, Example, How to Calculate Cap Rate Different Types Of Cap Rates a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. Cap rate, or capitalization rate, measures return on investment in commercial real estate, similar to pe. two types of cap rates are commonly used in property valuation. Some aggressive investors target cap rates above 8% or. some specific elements. Different Types Of Cap Rates.

From aeiconsultants.com

Cap Rates 101 Why They Matter in CRE Investments AEI Consultants Different Types Of Cap Rates Gross capitalization rate (gross cap rate) is. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. two types of cap rates are commonly used in property valuation. Some aggressive. Different Types Of Cap Rates.

From www.realestateskills.com

What Is A Good Cap Rate? Calculator & Formula for Real Estate Different Types Of Cap Rates Cap rate, or capitalization rate, measures return on investment in commercial real estate, similar to pe. Gross capitalization rate (gross cap rate) is. capitalization rates are a universal benchmark for comparing investment opportunities across different property. two types of cap rates are commonly used in property valuation. Some aggressive investors target cap rates above 8% or. the. Different Types Of Cap Rates.

From collectiveinvesting.com

What is a Cap Rate? (And Why Does It Matter?) Collective Investing Different Types Of Cap Rates capitalization rates are a universal benchmark for comparing investment opportunities across different property. Some aggressive investors target cap rates above 8% or. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. two types of cap rates are commonly used in property valuation. a cap rate (capitalization. Different Types Of Cap Rates.

From activerain.com

How to Determine a CAP Rate Different Types Of Cap Rates capitalization rates are a universal benchmark for comparing investment opportunities across different property. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. some specific elements that can influence cap rates are property location, condition, asset class, investment size,. Gross capitalization rate (gross cap rate) is. generally,. Different Types Of Cap Rates.

From www.thespreadsite.com

We define Cap Rates, show how they are calculated, and used Different Types Of Cap Rates Some aggressive investors target cap rates above 8% or. Cap rate, or capitalization rate, measures return on investment in commercial real estate, similar to pe. Gross capitalization rate (gross cap rate) is. some specific elements that can influence cap rates are property location, condition, asset class, investment size,. the capitalization rate is a profitability metric used to determine. Different Types Of Cap Rates.

From snapinnovations.com

What is Cap Rate? A Comprehensive Guide Snap Innovations Different Types Of Cap Rates the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. Some aggressive investors target cap rates above 8% or. some specific elements that can influence cap rates are property location,. Different Types Of Cap Rates.

From www.loyalhomes.ca

The Importance of Cap Rates in Real Estate Investing Different Types Of Cap Rates Gross capitalization rate (gross cap rate) is. generally, a “good” cap rate is between 5% and 10%. two types of cap rates are commonly used in property valuation. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. capitalization rates are a universal benchmark for comparing investment. Different Types Of Cap Rates.

From www.plantemoran.com

Return metrics explained What is a cap rate in commercial real estate? Our Insights Plante Different Types Of Cap Rates the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. some specific elements that can influence cap rates are property location, condition, asset class, investment size,. capitalization rates are a universal benchmark for comparing investment opportunities across different property. a cap rate (capitalization rate) is the ratio. Different Types Of Cap Rates.

From www.fca-grp.com

Cap & Interest Rates Infographic First Capital Advisors Different Types Of Cap Rates generally, a “good” cap rate is between 5% and 10%. a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. capitalization rates are a universal benchmark for comparing investment. Different Types Of Cap Rates.

From www.coachcarson.com

Cap Rate Explained For 2022 (And Why It Matters With Rental Properties) Coach Carson Different Types Of Cap Rates Gross capitalization rate (gross cap rate) is. a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. Some aggressive investors target cap rates above 8% or. some specific elements that can influence cap rates are property location, condition, asset class, investment size,. generally, a “good” cap rate is between. Different Types Of Cap Rates.

From dealcheck.io

Understanding the Capitalization Rate (Cap Rate) for Rental Properties DealCheck Blog Different Types Of Cap Rates a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. Gross capitalization rate (gross cap rate) is. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. Cap rate, or capitalization rate, measures return on investment in commercial real estate, similar. Different Types Of Cap Rates.

From www.slideserve.com

PPT Understanding Capitalization Rates Definition, Calculation, and Importance PowerPoint Different Types Of Cap Rates generally, a “good” cap rate is between 5% and 10%. some specific elements that can influence cap rates are property location, condition, asset class, investment size,. Some aggressive investors target cap rates above 8% or. a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. capitalization rates are. Different Types Of Cap Rates.

From www.pinterest.com

What Is Cap Rate and How to Calculate It? Infographic What is cap, Real estate infographic Different Types Of Cap Rates capitalization rates are a universal benchmark for comparing investment opportunities across different property. generally, a “good” cap rate is between 5% and 10%. Cap rate, or capitalization rate, measures return on investment in commercial real estate, similar to pe. the capitalization rate is a profitability metric used to determine the return on investment of a real estate. Different Types Of Cap Rates.

From successfullyunemployed.co

Cap Rate and What Every Investor Needs to Know PLUS Calculator Successfully Unemployed Different Types Of Cap Rates the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. Gross capitalization rate (gross cap rate) is. a cap rate (capitalization rate) is the ratio of net operating income (noi) to the property asset value. capitalization rates are a universal benchmark for comparing investment opportunities across different property.. Different Types Of Cap Rates.

From dxogowquy.blob.core.windows.net

What Is Cap Rate On A Property at Nicholas Hoyt blog Different Types Of Cap Rates Cap rate, or capitalization rate, measures return on investment in commercial real estate, similar to pe. Some aggressive investors target cap rates above 8% or. some specific elements that can influence cap rates are property location, condition, asset class, investment size,. capitalization rates are a universal benchmark for comparing investment opportunities across different property. generally, a “good”. Different Types Of Cap Rates.